Jio Financial denies being in talks to acquire Paytm’s wallet business, On local exchanges on Monday, Jio Financial Services’ shares increased by over 15% in response to the speculative rumors.

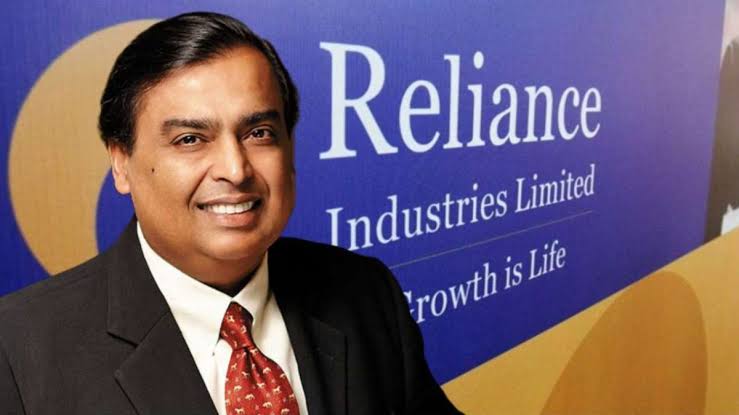

The Jio Financial Services spin-off from Reliance Industries stated on Monday night that it is not in talks to buy Paytm’s wallet business. This dispelled “speculative” media claims as the Noida-based company works to contain the fallout from the central bank’s crackdown last week.

Over the weekend, The Hindu Businessline revealed that Paytm and Jio Financial Services had been in talks for a deal for months. The situation intensified when the Indian central bank expanded its enforcement against Paytm’s Payments Bank, the division responsible for handling transactions for the company that dominates the financial services industry. On local exchanges on Monday, Jio Financial Services’ shares increased by over 15% in response to the speculative rumors. In the previous three working days, however, Paytm’s market cap has decreased by over 40%.

Related: IMTO exchange rate restrictions lifted by the Central Bank

Paytm Payments Bank is not permitted by the RBI to provide a number of banking services, including the acceptance of new deposits and credit transactions for all of its services. The parent company of the well-known Paytm mobile payments service has announced that it will stop doing business with its affiliate and look to collaborate with other banks in order to maintain many of its key operations.

originally revealed last week, the Reserve Bank of India is thinking of fining Paytm more and perhaps even canceling its bank license. The 330 million wallet users of Paytm are housed at Paytm Payments Bank, an affiliate of Paytm. Paytm was obliged to give up its PPI license, which was necessary to run the wallet business, in early 2018 when it was granted the Payments Bank license, which permits the holder to offer consumers a savings account of up to $2,400.

Last year, Reliance listed Jio Financial Services, a little-known non-bank financial company. With roughly 6% ownership in Reliance, Jio Financial Services is steadily growing its lending and insurance operations.