Almost immediately, the CBN appoints new executive teams for Keystone, Polaris, and Union Banks following the dissolution of the previous Board and Management.

The management was dissolved on Wednesday, and according to speculations they were dissolved based on the recommendation of Jim Obazee who was appointed by President Tinubu to probe into the activities of these banks.

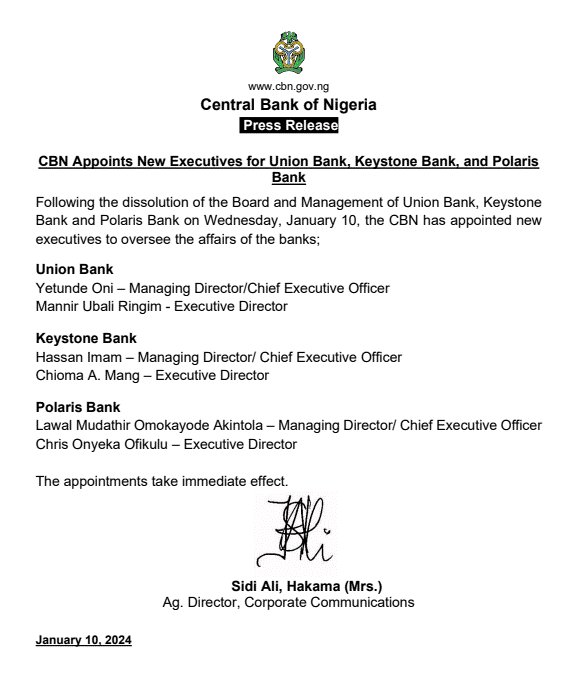

Hakama Sidi Alli, the acting director of corporate communications at the CBN, announced the appointment of Mannir Ubale Ringim as executive director and Yetunde Oni as managing director/chief executive officer of Union Bank in a statement late on Wednesday.

Hassan Imam is also mentioned; he will lead Keystone Bank as managing director and chief executive officer. Chioma A. Mang is going to be the bank’s executive director.

Related: CBN sacks boards of Union, Keystone, Polaris banks

Polaris Bank also revealed the appointment of Lawal Mudathir Omokayode Akintola as managing director/chief executive officer and Chris Onyeka Ofikulu as executive director, forming a new leadership team.

According to the CBN announcement, the appointments are effective immediately.

Hassan Imam (Keystone Bank) held the position of executive director at Fidelity Bank before her employment, while Yetunde Oni (Union Bank) was the managing director/chief executive officer at Standard Chartered Bank, Sierra Leone.

Polaris Bank’s new executive, Omokayode Mudathir Akintola Lawal, previously held the position of CEO at Intermediate Equity Partners Ltd. in Lagos and executive director at Sterling Bank.

Mannir Ubale Ringim was the deputy general manager and head of the North West 1 regional bank at Fidelity Bank before being appointed executive director at Union Bank. Conversely, the recently appointed executive director of Keystone Bank, Chioma A. Mang, was previously the managing director of the United Bank for Africa in Sierra Leone. Chris Onyeka Ofikulu was the regional CEO of UBA West Africa before he was appointed executive director at Polaris Bank.

The Union Bank, Keystone Bank, and Polaris Bank boards and management were earlier dissolved by the CBN on Wednesday for allegedly “non-compliance with the provisions of Section 12(c), (f), (g), (h) of Banks and Other Financial Institutions Act, 2020.”

The regulator assured depositors and the public that their money was safe and secure “The bank’s infractions vary from regulatory non-compliance, corporate governance failure, disregarding the conditions under which their licenses were granted, and involvement in activities that pose a threat to financial stability, among others,” the regulator stated.

The largest economy in Africa’s banking sector is still robust and healthy, according to the CBN, which also reaffirmed its commitment to maintaining a safe, sound, and robust financial system in Nigeria.

CBN Appointment of New Executives