Hope floods the cryptocurrency space in Nigeria as CBN Finally Lifts Ban on Cryptocurrency transactions. This is a huge step towards what is considered financial and economic progress as many would consider it.

To this effect, CBN has now given clearance to banks and other financial institutions to provide services to cryptocurrency exchanges and dealers also known as Virtual Assets Providers, VAPs.

As a result, the CBN stated that financial institutions can now open accounts for VAPs, provide designated settlement accounts and settlement services, operate as channels for foreign exchange flows and trade, and perform any other activity that the CBN may sanction from time to time.

However, the CBN stated that VAP bank accounts cannot be used for cash withdrawals or third-party cheques.

The CBN, on the other hand, prohibited banks from holding or transacting in cryptocurrencies.

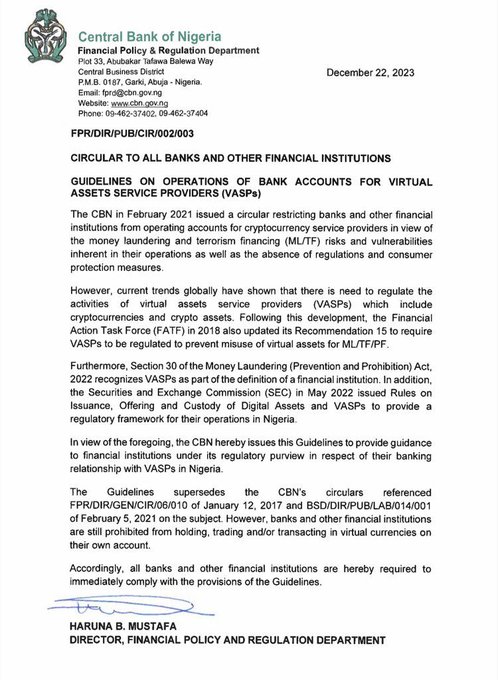

Haruna Mustafa, CBN’s Director of Financial Policy and Regulation, published the new instruction in a circular to banks and other financial institutions titled, Guidelines on Operations of Bank Accounts for Virtual Assets Providers, VAPs).

Related: Bonk Pump Boosts Solana Saga Phones Sales Eight Times its Retail Cost

The Circular ”The CBN in February 2021 issued a circular restricting banks and other financial institutions from operating accounts for cryptocurrency service providers in view of the money laundering and terrorism financing (ML/TF) risks and vulnerabilities inherent in their operations as well as the absence of regulations and consumer protection measures.

“However, current trends globally have shown that there is need to regulate the activities of virtual assets service providers (VASPs) which include cryptocurrencies and crypto assets. Following this development, the Financial Action Task Force (FATF) in 2018 also updated its Recommendation 15 to require VASPs to be regulated to prevent misuse of virtual assets for ML/TF/PF.

“Furthermore, Section 30 of the Money Laundering (Prevention and Prohibition) Act, 2022 recognizes VASPs as part of the definition of a financial institution. In addition, the Securities and Exchange Commission (SEC) in May 2022 issued Rules on Issuance, Offering and Custody of Digital Assets and VASPs to provide a regulatory framework for their operations in Nigeria.

“In view of the foregoing, the CBN hereby issues this Guidelines to provide guidance to financial institutions under its regulatory purview in respect of their banking relationship with VASPs in Nigeria.

“The Guidelines supersedes the CBN’s circulars referenced FPR/DIR/GEN/CIR/06/010 of January 12, 2017 and BSD/DIR/PUB/LAB/014/001 of February 5, 2021 on the subject. However, banks and other financial institutions are stili prohibited from holding, trading and/or transacting in virtual currencies on their own account.”

CBN Finally Lifts Ban on Cryptocurrency