The CBN sacks boards of Union, Keystone, Polaris banks, The decision was announced by CBN in a statement on Wednesday night.

Jim Obazee, the Special Investigator that President Bola Tinubu appointed in July 2023, is believed to have made the proposal that led to the action.

Mr. Obazee was assigned to look into the CBN’s and other pertinent organizations’ operations.

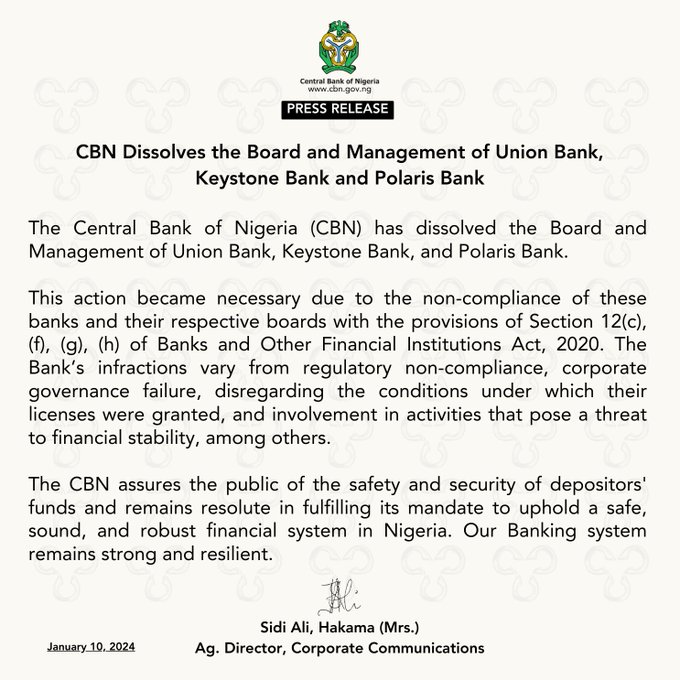

In its announcement on Wednesday, the CBN charged the banks with a number of offenses, including corporate governance failure and regulatory non-compliance.

The Banks and Other Financial Institutions Act, 2020’s Section 12(c), (f, (g), th) provisions were not being followed by these banks and their respective boards, which is why this action was required, according to a news release issued by the bank’s spokeswoman, Sidi Hakama.

Related: Tinubu suspends Minister of Humanitarian Affairs and Poverty Alleviation

According to the CBN, the banks’ violations range from corporate governance failure to regulatory non-compliance, disobeying the terms of their licenses, and engaging in activities that jeopardize financial stability, among other things.

The previous governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, used “ill-gotten wealth” to establish TTB and used it to acquire Union Bank and Keystone Bank through certain individuals acting as his proxies, according to a report Mr. Obazee submitted to President Bola Tinubu on December 20.

Through Mr. Obazee’s research, dubious ownership and debts connected to Mr. Emefiele were discovered. It was also his recommendation that the federal government relinquish the banks.

Tropical General Investment Group (TGI)

Tropical General Investment Group (TGI) defended itself by stating that the necessary process was followed in the transaction and that the USD 500 million capital utilized to pay for the purchase of Union Bank was transparent and unquestionable.

“The entire transaction was managed by highly reputed global financial institutions including Rothschild and Citibank.

“A USD 300 million loan was sourced from African Export-Import Bank (Afrexim) and the rest of the capital was sourced from the proceeds of TGI’s sales of its Chi Ltd business to Coca-Cola, all to finance the acquisition of Union Bank,” it said.

Official CBN letter of Board Termination