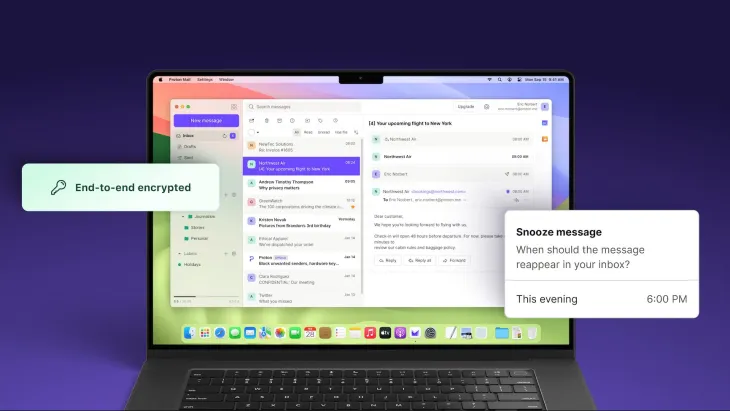

Cash management, keeping track of who needs to pay an invoice and whether it has been paid can make or break a company. After seeing strong demand, a startup developing SaaS software to help finance departments manage this more intelligently has announced some funding to expand.

Growfin, a Singapore and San Francisco-based fintech startup that provides SaaS for finance departments to track and collect payments as well as manage accounts receivable, has raised $7.5 million in Series A funding. The company intends to use this funding to continue its expansion in the United States and Asia, as well as to double down on developing more AI-based technology to expand its platform. Following that will be a forecasting tool that forecasts trends based on past payment behavior and current receivables data from Growfin.

SWC Global of Singapore led the funding round, which also included existing backers 3one4 Capital and angel investors. The startup claims that the latest funding comes on the heels of an 8x increase in customer numbers over the last year, during which Growfin assisted clients to collect more than $1 billion in account receivables (AR). Growfin has now raised $9 million in total but has not disclosed its valuation.

Also, read: Tesla slashes prices for Model S and Model X in the U.S

Growfin is entering a ripe market, not least because of the current economic climate and the pressures it is putting on businesses of all sizes.

According to a recent Gartner report, 78% of CFOs have invested in automation and cash flow visibility technology. While they are increasingly willing to pay for tools to help them plan for the future, many still rely on spreadsheets for current accounts, exposing a gap between having visibility of a company’s current financial state and knowing how that relates to what it might look like in a week, month, or year.

Growfin’s first product was an AI-powered finance CRM that finance, sales, and customer success teams could use to connect in one place to handle customer relationships during payment and cash-collecting processes, a clever bridging product that speaks to how accounts receivable departments might sometimes do better if they could join forces and knowledge with those who manage the majority of the customer relationship prior to that point. (In fact, a more pleasant experience may lead to more sales in the future.)

Instead of developing an AR automation product, the company created a finance CRM that not only automates finance accounts receivable workflows but also provides the necessary collaboration capabilities and real-time visibility to sales, customer success, and customers themselves in a single location (where they can be accessed).

That initial push for greater financial transparency was successful. Growfin’s primary users are B2B tech companies in SaaS, adtech, logistics tech, and edtech, and it now has 25 customers, including Intercom, Fourkites, Mindtickle, LeadSquared, and Quick Dry Restoration, according to Aravind Gopalan, co-founder, and CEO of Growfin. It primarily sells to finance teams, but as you might expect, revenue-generating teams such as sales and customer success also use its service. Since its inception a year ago, the startup claims to have generated $400,000 in annual recurring revenue.

Growfin is used by Intercom to automate and track its collection activities, integrating with NetSuite, Zuora, and Salesforce and providing finance leaders with real-time visibility. Gopalan elaborated “We helped them reduce their cash collection cycle from 91 days to 59 days in a span of 5 months, improving collection efficiency by 35%,” he said.

About Growfin

Growfin is a financial technology (FinTech) company that provides an AI-powered software-as-a-service (SaaS) solution for cash collection and credit management. Their solution is designed to help businesses optimize their cash flow by automating and streamlining the process of collecting outstanding payments.

The company was founded in 2017 in Belgium and has since expanded to serve customers in multiple countries across Europe. Growfin’s SaaS solution uses machine learning algorithms and natural language processing to analyze customer data and automate payment reminders and follow-ups.

Growfin’s technology also includes a dashboard that provides real-time insights into cash flow and credit management performance, allowing businesses to monitor their performance and make data-driven decisions.

Overall, Growfin’s solution is designed to help businesses improve their cash flow and reduce the time and effort required to manage outstanding payments. With the expansion of its SaaS solution into the US and Asia, Growfin is positioning itself to tap into two of the world’s largest and most dynamic economies and help even more businesses optimize their cash flow and credit management processes.