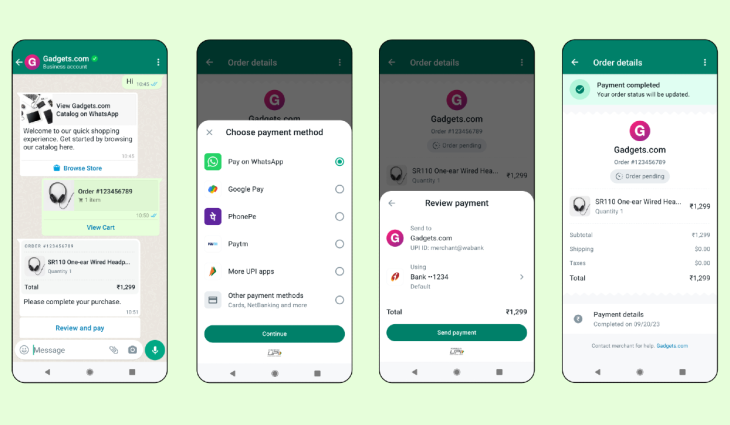

In India WhatsApp users can now pay companies using credit cards and other UPI apps – WhatsApp is introducing a new feature in India that will allow users in the company’s largest market to pay companies from within the instant messaging app using a range of payment methods.

On Wednesday, the app announced a partnership with PayU and Bengaluru-based Razorpay to enable support for payments via credit and debit cards, net banking, and all UPI apps in India.

Wednesday’s move comes after WhatsApp partnered with Stripe earlier this year to allow its Singapore users to pay businesses through the service. In June, the app also facilitated merchant payments in Brazil.

“This is going to make it even easier for people to pay Indian businesses within a WhatsApp chat using whatever method they prefer,” said Mark Zuckerberg in his virtual remarks in Mumbai at the company’s Conversations 2023 event.

According to WhatsApp, the payment feature is available to all businesses in India that use the WhatsApp Business platform.

With over 500 million WhatsApp users in India, the South Asian market is Meta’s largest globally. In a trial version that was expanded to 100 million users last year, the app initially provided its payment services — built on top of UPI — in India in 2020. However, it continues to face stiff competition from the likes of Google Pay, Walmart-owned PhonePe, and Indian fintech behemoth Paytm, which dominate the UPI ecosystem.

Previously, Indian businesses on WhatsApp could accept payments from clients via UPI-based WhatsApp Pay. Last year, Indian conglomerate Reliance Industries used that support to provide an end-to-end purchasing experience on WhatsApp via its JioMart bot. However, the most recent update improves the customer experience by adding third-party payment alternatives for merchants selling things via the app.

It also expands the possibilities for users and businesses to utilize WhatsApp as a commerce solution. Nonetheless, despite having over 200 million monthly active users on its business app worldwide, the messaging app has yet to see a substantial percentage of its regular users make purchases through its platform in India.

WhatsApp Business has been an important source of revenue for WhatsApp, which does not charge users directly through subscriptions and has no plans to show ads in chats.

The app offered paid features for automation and personalized merchant communications earlier this year. Improved payment capabilities may increase income as more users shop through WhatsApp, enticing more businesses. WhatsApp’s in-app purchasing experience will also be enhanced via a feature called Flows, which will allow users to execute things like selecting a seat on a flight or booking an appointment directly from the messaging app.