Written By Nicholas Walter | Updated: 12 September 2024

Through the Tokyo International Conference on African Development (TICAD) initiative, Japan has expressed interest in increasing its investment in the African digital industry, particularly in Nigeria.

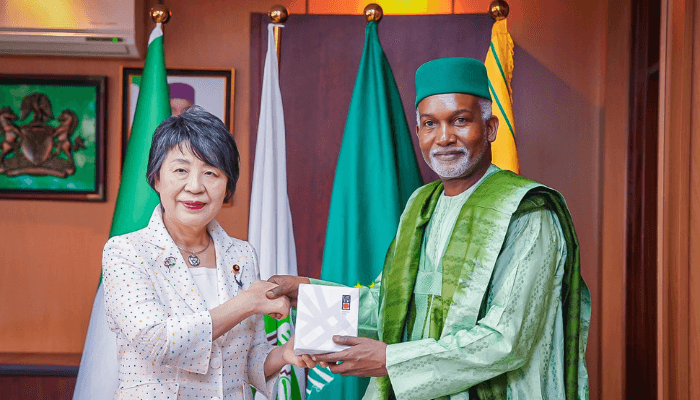

This was revealed during the TICAD ministerial meeting between Yusuf Tuggar, the minister of foreign affairs of the Federal Republic of Nigeria, and Yoko Kamikawa, the minister of foreign affairs of Japan. With an emphasis on startups, the Japanese minister talked about measures to improve commercial and economic ties between the two nations.

TICAD is an international conference with an emphasis on Africa’s development. Nigeria, a country with a population of over 200 million, boasts a thriving digital sector that has drawn over $4.4 billion in investment in the previous five years, according to data from Africa; The Big Deal. Reports indicate that the country’s tech-savvy populace and market potential are key factors in the ecosystem’s growth.

Nevertheless, the ecosystem’s funding has been dwindling. Funding decreased by almost 45% in the first quarter of 2024, to $466 million, reflecting a 9 percent quarterly loss and a 47 percent annual decline.

Also Read: Tecno AI Vision for Smart Devices Announced, New AI Features and Ella Virtual Assistant Update

Japan has a long-standing interest in Africa. Through Japanese venture capital businesses such as Verod Kepple, Japan invested $726 million in Africa in 2022. Since its investment approach in Nigeria centers on patient capital provision, Japan’s primary contribution to Nigeria’s tech ecosystem has been through corporate venture capital (CVC).

Japan is home to over 10,000 startups and has a population of 123 million people, according to the UN. As per the Japan Startup Ecosystem Report 2023, investments in startups in Japan have increased tenfold over the last ten years, amounting to 850 billion yen ($6 billion) in 2023. According to a Tracxn analysis, the Asian nation ranks 19th globally on the list of nations with unicorns and boasts approximately 9 unicorn firms.

According to experts, Japan’s decision to invest in Nigeria will support local startups and strengthen its position globally. They did point out that the ecosystem might not benefit greatly from this funding. Lendsqr’s creator, Adedeji Olowe, stated, that Japanese investment will benefit founders. Founders succeed even in the absence of capital. Thus, how much more can be funded?

In addition to finance, he said Japan might introduce founders to overseas knowledge. He emphasized, “If these investors are serious, they could go beyond money and connect founders with expertise from Japan, as this will help greatly,” he highlighted.

Olowe, however, expressed doubt about the investments, speculating that there might be a disconnect because Japan is a country that is primarily driven by hardware while Nigerian entrepreneurs are primarily focused on software as a service.

He added “Nigerian founders are mostly software SaaS-based founders, while Japan is mostly hardware country, so I think there may be a challenge. And even when you talk of hardware they do, they do the premium end of the chain, not the mass market hardware you get from China.”

Zeeh Africa’s creator, David Adeleke, stated that Japan will gain from understanding Western investing practices.

“The Japanese are entering the system now with greater caution. They are not falling into the same traps that the West fell into again. This time, they are approaching investments with proper due diligence, carefully assessing startups before they invest,” he said.

“Whether they find it more attractive and choose to fill the void or large space that Western investors previously occupied is something that time will reveal. But one thing is certain: they are coming, and this time, they are being cautious, ensuring they conduct thorough due diligence before investing in any startup.”

While Japan’s interest may not be able to reverse the financial winter, Davidson Oturu, managing partner and venture capitalist at Nubia Capital, pointed out that it would increase the amount of available funding.

“I don’t think Japan’s interest will completely reverse the funding winter on the continent, but it introduces a new funding entity to the market, which could see more capital come in and could even also attract other investors. Also, having Japan in the mix diversifies the sources of capital for Nigerian startups. This would reduce reliance on regular sources of funding,” he said.

Zeeh Africa’s Adeleke went on to say that since these inflows of capital are inevitable, the government has to make sure that they don’t devalue local assets or put the interests of its people at risk.

“The government must prioritize and protect the people’s interests. We don’t want a situation where a foreign investor arrives and, because they bring money, we end up losing our value, almost as if we’re selling our birthrights simply because we’re enticed by the money they offer.

“In Rwanda, for example, there are adequate policies in place that first protect the interests of the citizens, whether they are business owners or end users. These policies are transparent, ensuring that you are fully informed as an external investor bringing in funds. They have created a fair playing field where you, as an investor, can bring your money, make good returns, and still avoid jeopardizing the founders’ interests or disrupting the existing structure.” he added.

The implications of Japan’s financing interest for Nigeria’s IT sector